Translator finances - FAQ

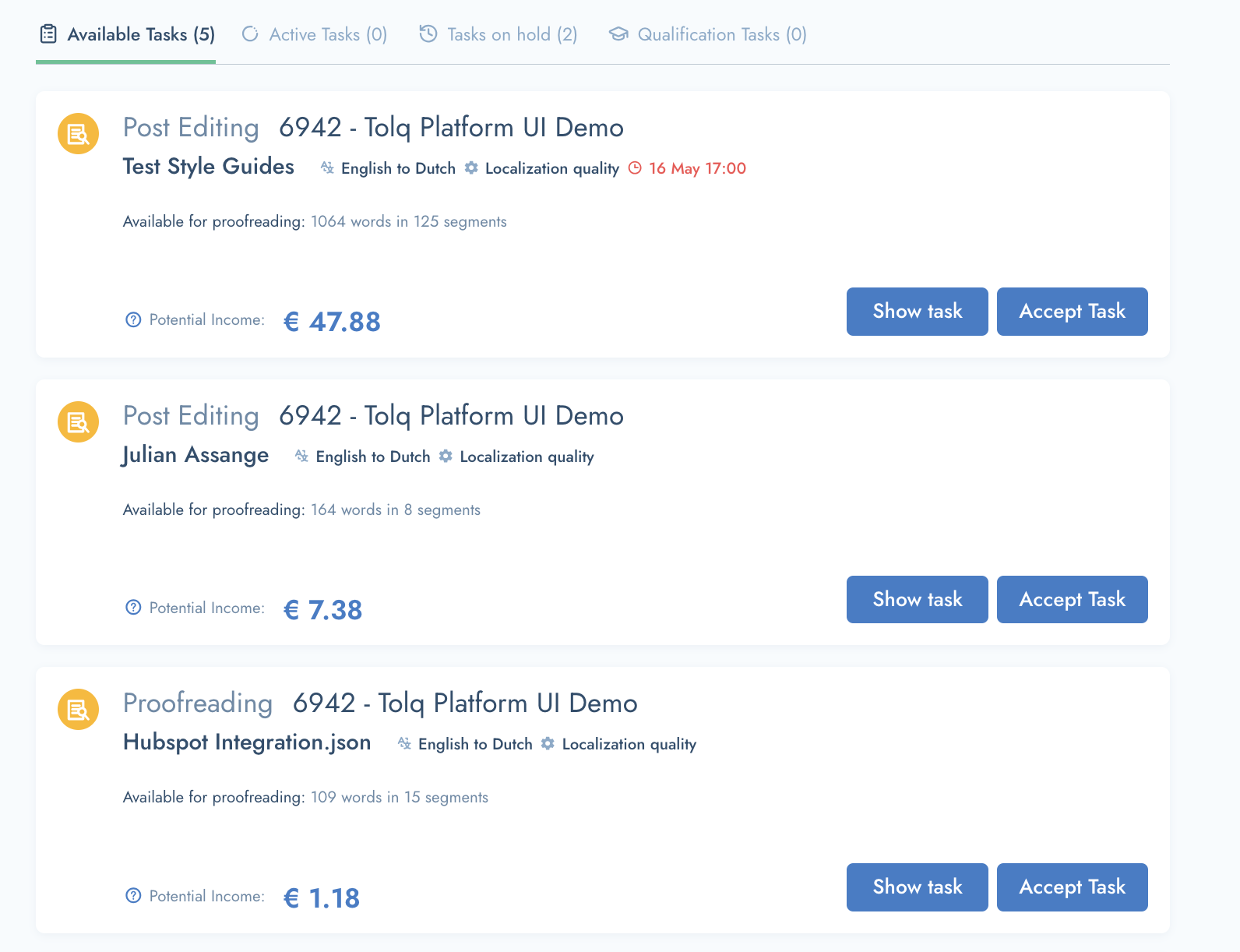

1. How much can I earn?

- The potential earnings vary depending on the project, typically ranging from €0.02 to €0.12 per word, based on factors like text complexity, ordered quality level and task availability.

- These rates are provided per task, and you can preview the potential earnings for each task on your dashboard before accepting it.

- As for setting your own rates - it's not an option at this stage.

- The offered earnings per task are fixed and displayed on your dashboard before you accept them.

- You can either choose to accept the offered rate or decline the task.

2. When can I expect to receive my earnings?

- After completing a translation task, the client has up to 2 weeks to review the translations and request any necessary corrections.

- If the client doesn't accept or request changes within this period, the translations will automatically be accepted.

- Once the translations are accepted—either by the client or automatically—there is an additional 3-week waiting period before your earnings are released to your account.

- Once your earnings are released, you can proceed to make a withdrawal.

- After you request a withdrawal, please allow us approximately seven working days to manually process the withdrawal and transfer your earnings to your account.

- We usually process withdrawals on Thursdays (every week). So, it's recommended to make your withdrawal before the Thursday for it to be processed on the Thursday.

- If seven working days have passed since your withdrawal request and you have not received your payment, please reach out to us at support@tolq.com, and we will investigate the matter for you.

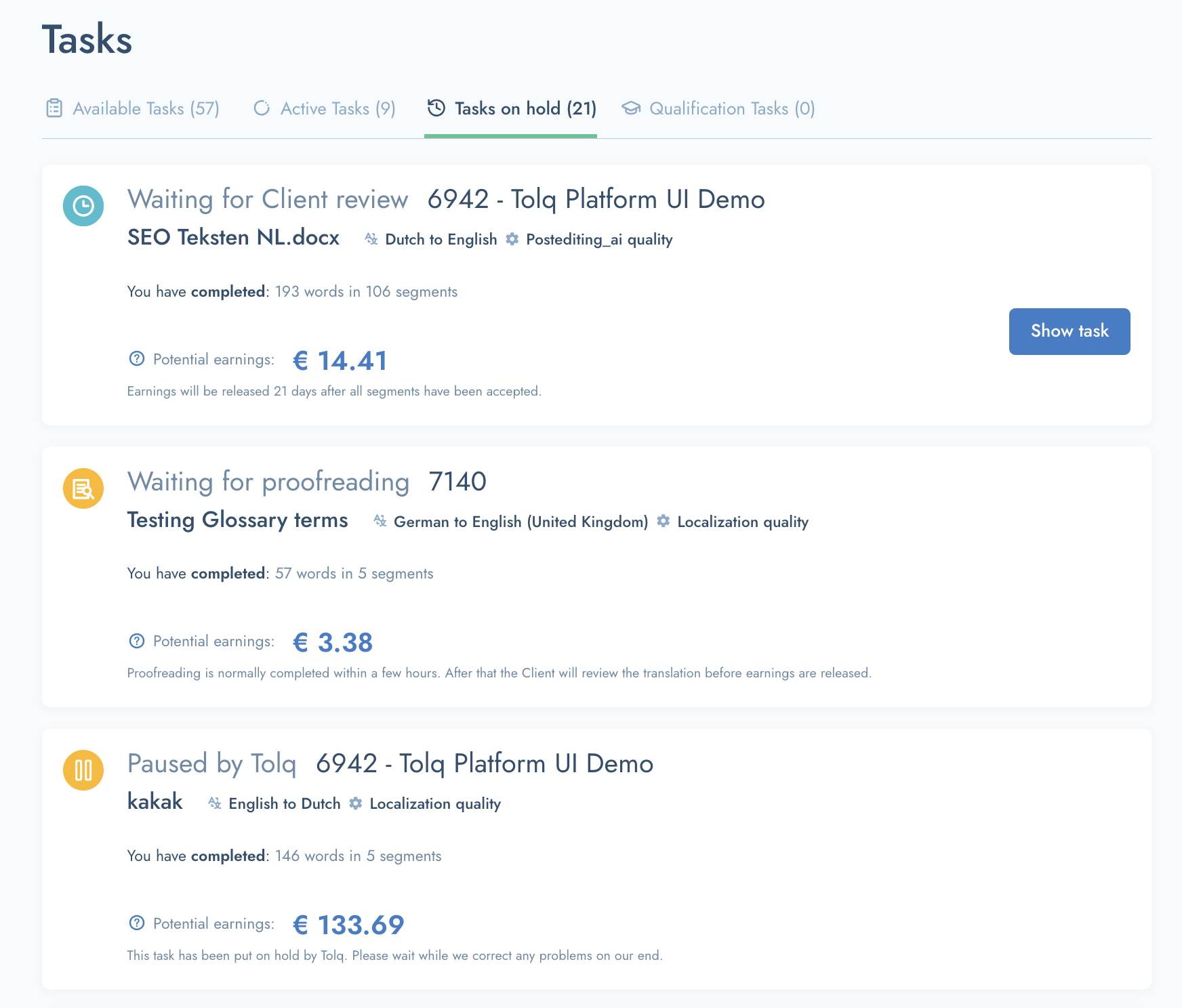

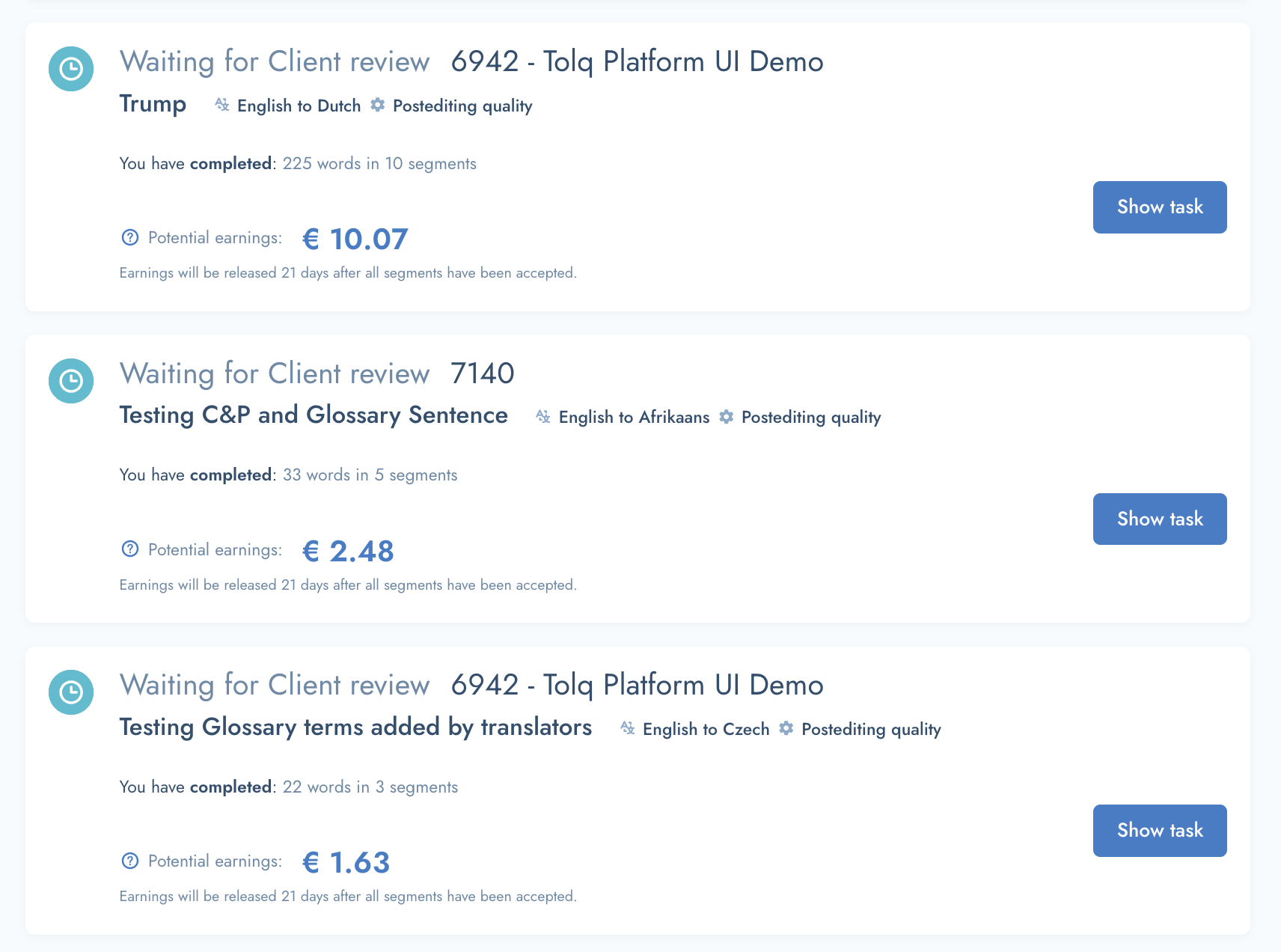

3. When will my earnings be released?

- You can track the progress of your tasks in the 'Tasks on hold' tab. Once the client accepts the translations, the release date will appear here.

- The release date is usually 3 weeks after the tasks have been "Accepted" by the client.

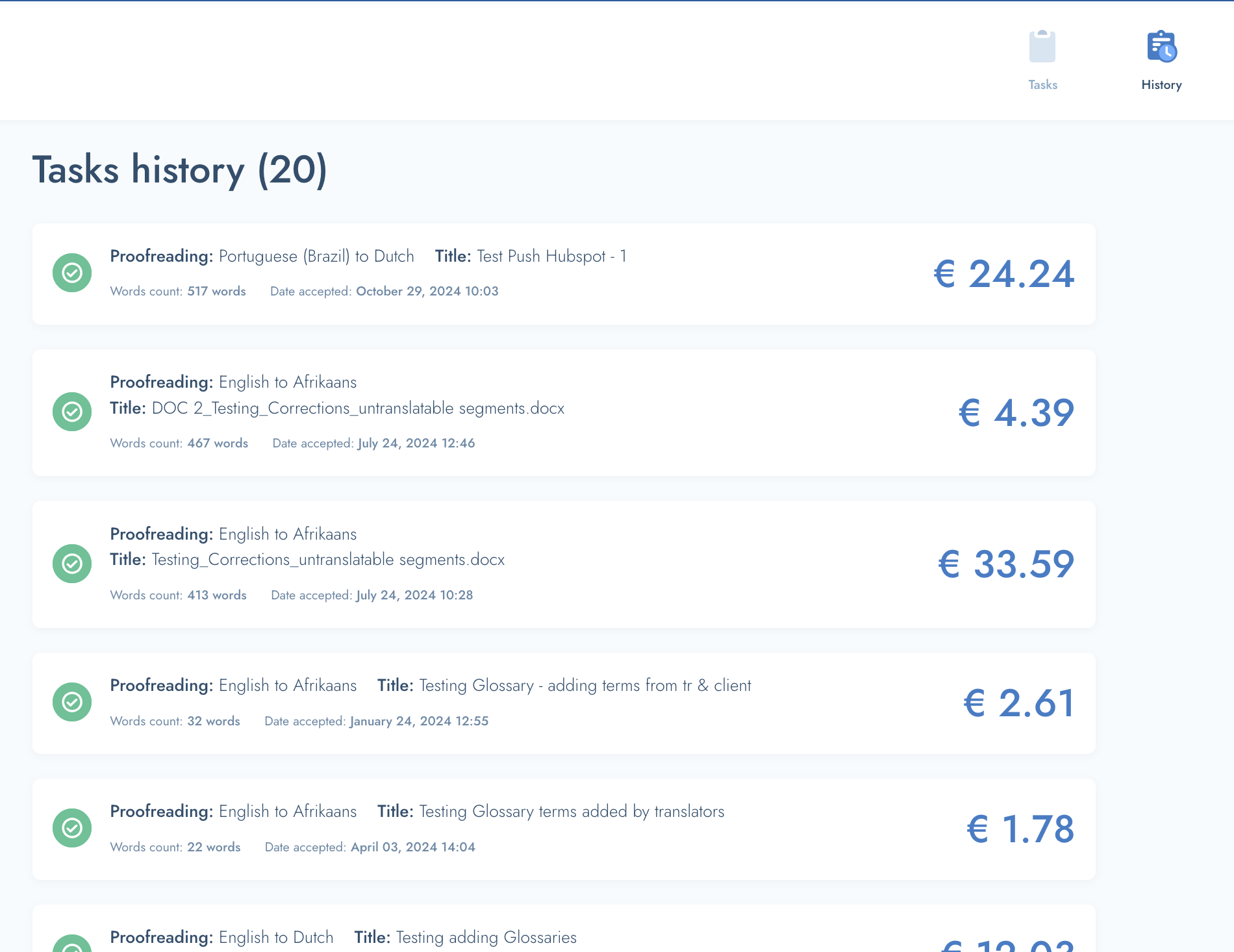

- Tasks with released earnings will be listed in the 'History' section of your dashboard.

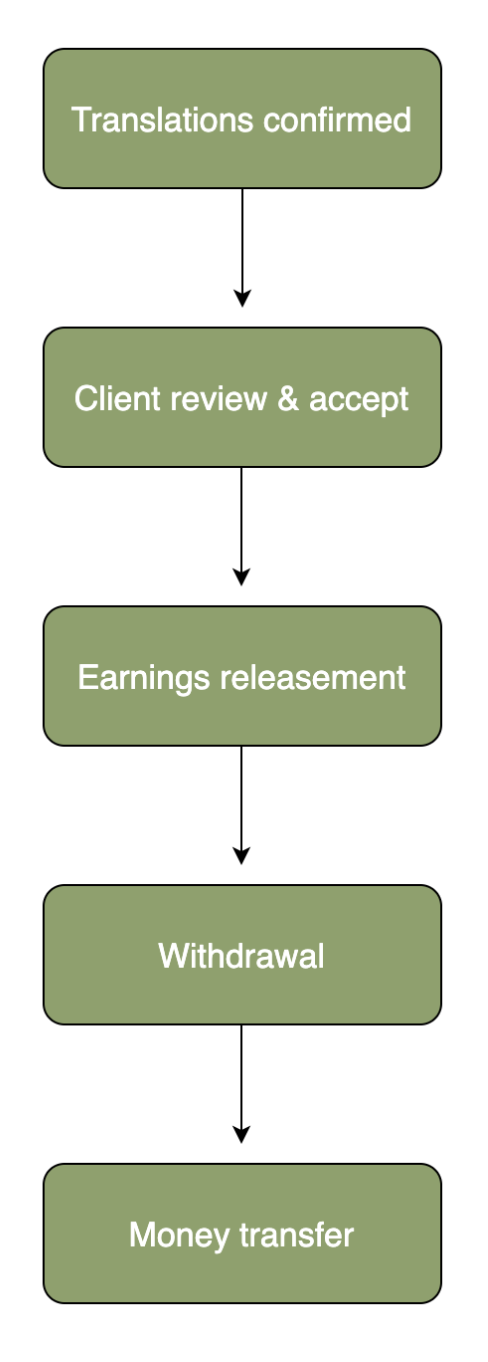

4. What does your payment process look like?

- Our payment process starts with a maximum 14-day review period during which clients review and accept translations.

- Typically, clients promptly review and accept translations after completion to begin using them.

- Once a task is accepted, there is an 3 week waiting period before the earnings are released into your account.

- To receive your earnings, simply submit a withdrawal request from your profile as soon as your earnings are released.

- Withdrawals can be made at any time, allowing you to either withdraw immediately or wait until you've accumulated a substantial amount.

- Withdrawals are processed manually and transferred within approximately 7 business days. We typically process payments every Thursday.

- If you would like your payment to be processed on the Thursday, please make the withdrawal request by the Wednesday.

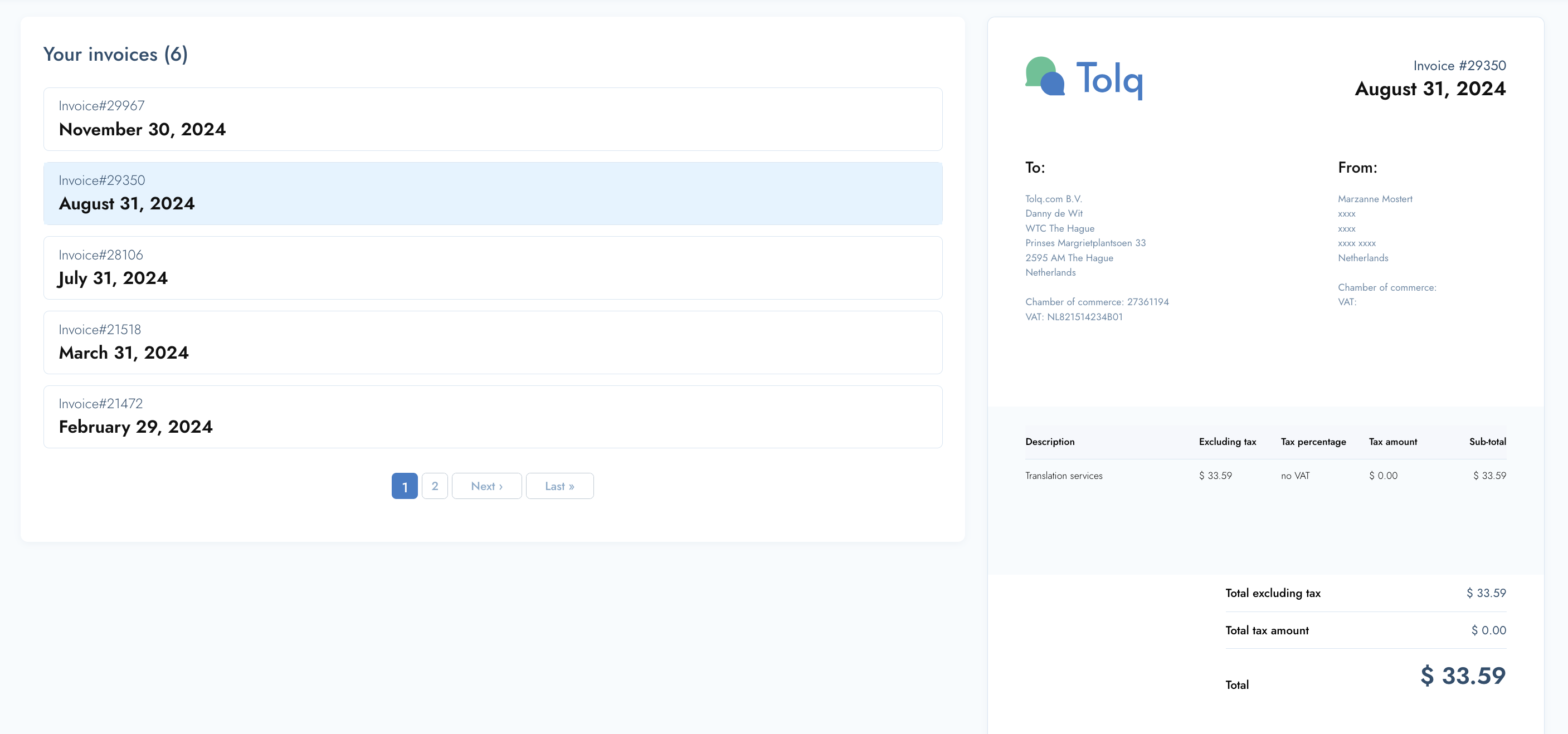

- Additionally, we automatically generate invoices for you on the 1st of each month, streamlining your administrative tasks.

In summary:

Client review → earnings released → withdrawal → manual processing and transfer

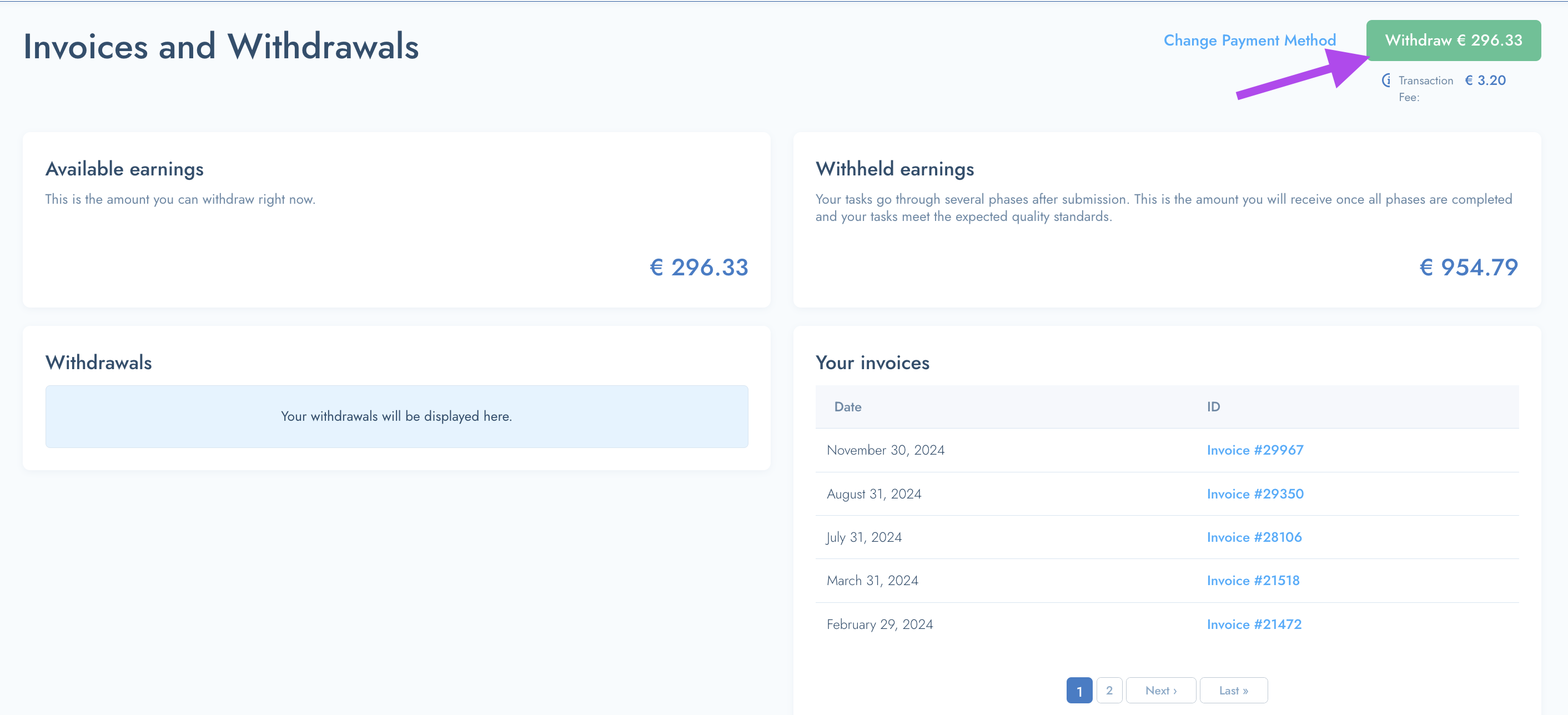

5. Are there any costs associated with withdrawals?

Yes, there are administrative costs associated with withdrawals, as each withdrawal is handled manually.

- For bank transfers, there is a fixed fee of approximately 3 Euros for each withdrawal.

- For PayPal withdrawals, PayPal charges a fixed fee of 0.35 Euros, along with a variable fee ranging from 3.4% to 1.5%, depending on the volume of transactions in the previous month and the recipient's country.

- You can enter and edit your payment details here.

- We recommend accumulating your earnings and withdrawing them once a month or every few months to minimize transaction fees.

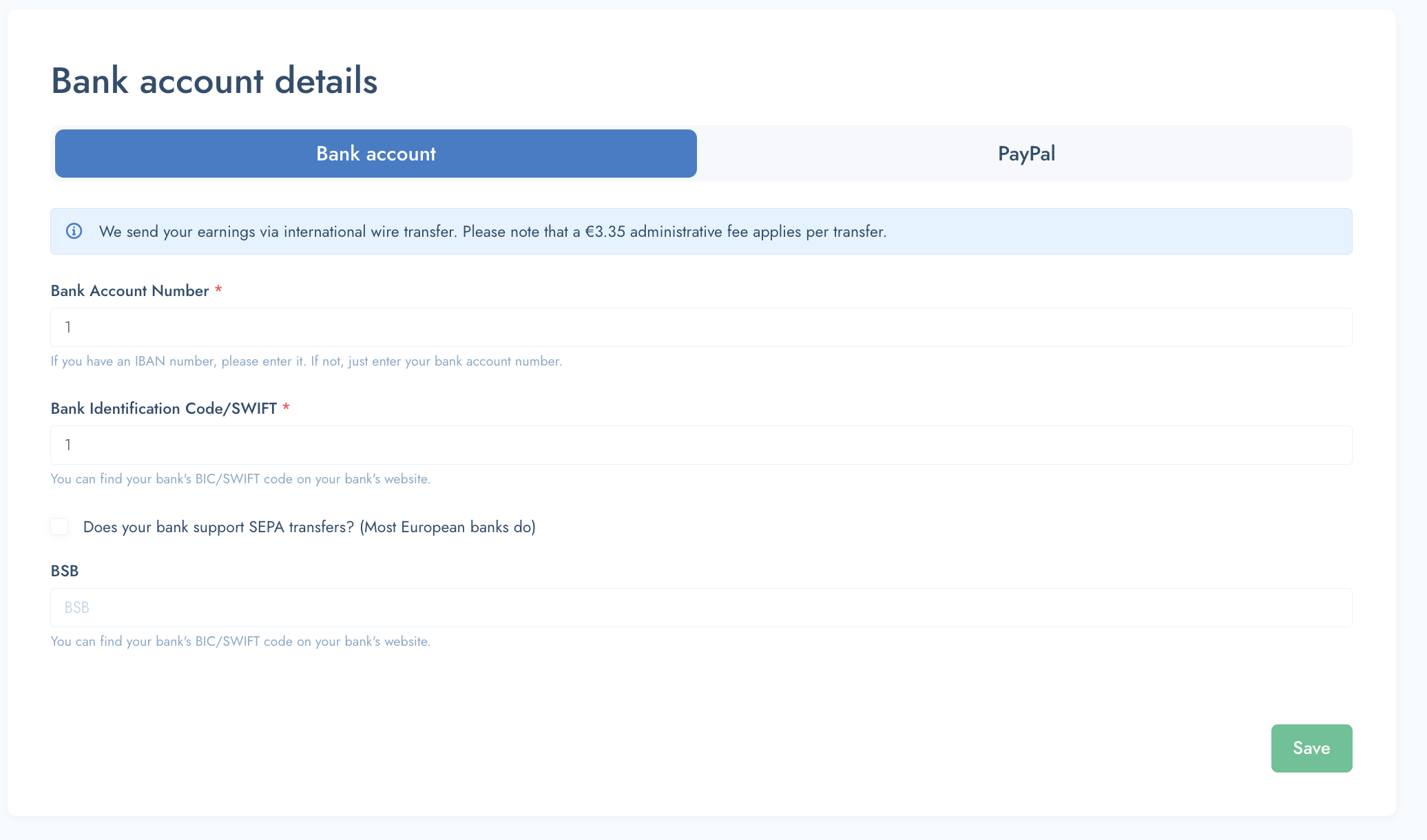

6. How can I update my payment method or banking details?

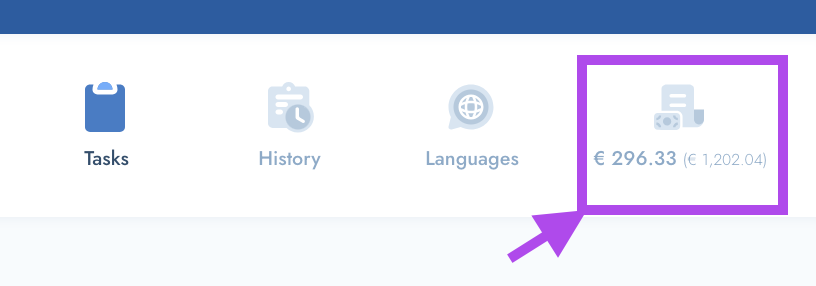

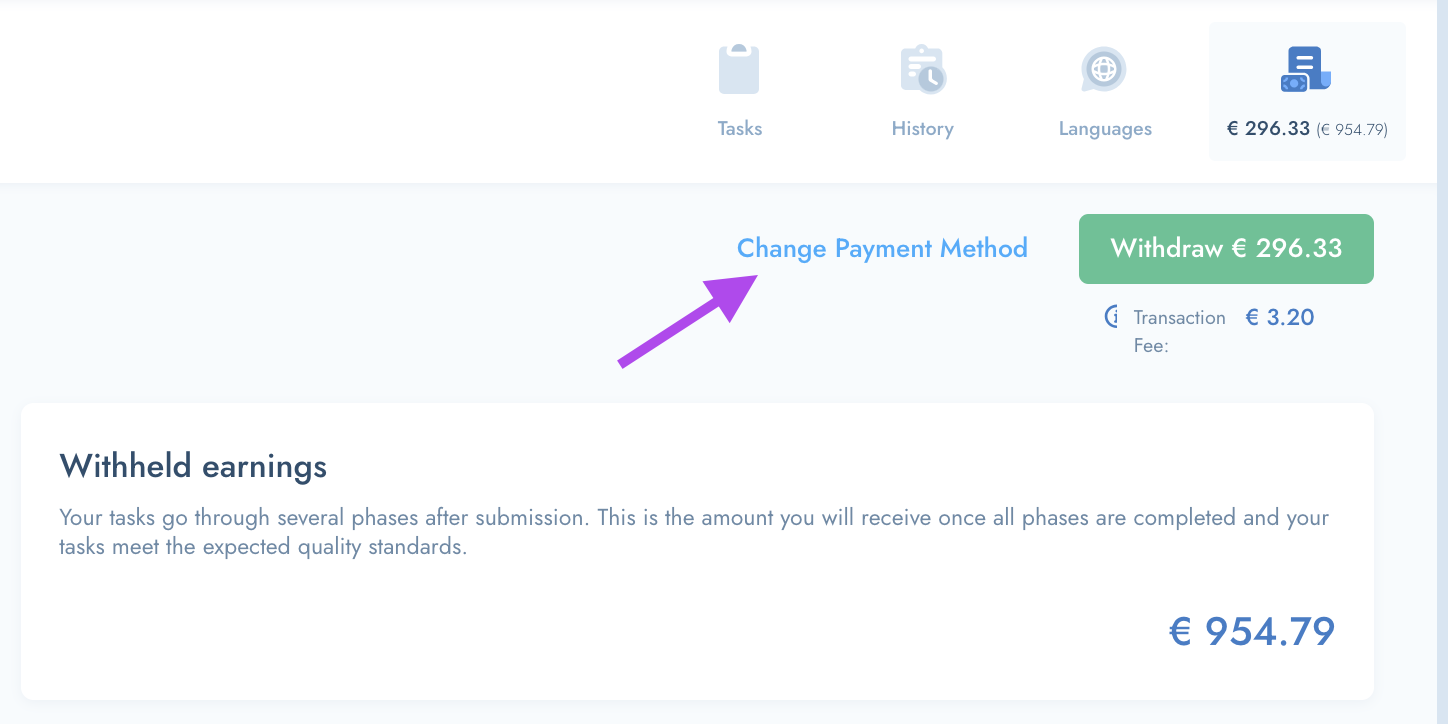

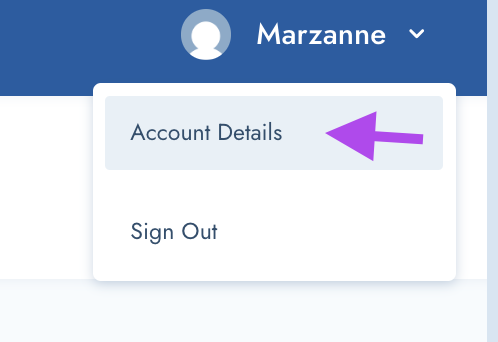

- To access everything finances, please click on this icon in the top right hand corner (underneath your name).

- You can also use this link: https://translators.tolq.com/invoices

- To access your selected payment method or change the details related to this, please click "Change Payment Method".

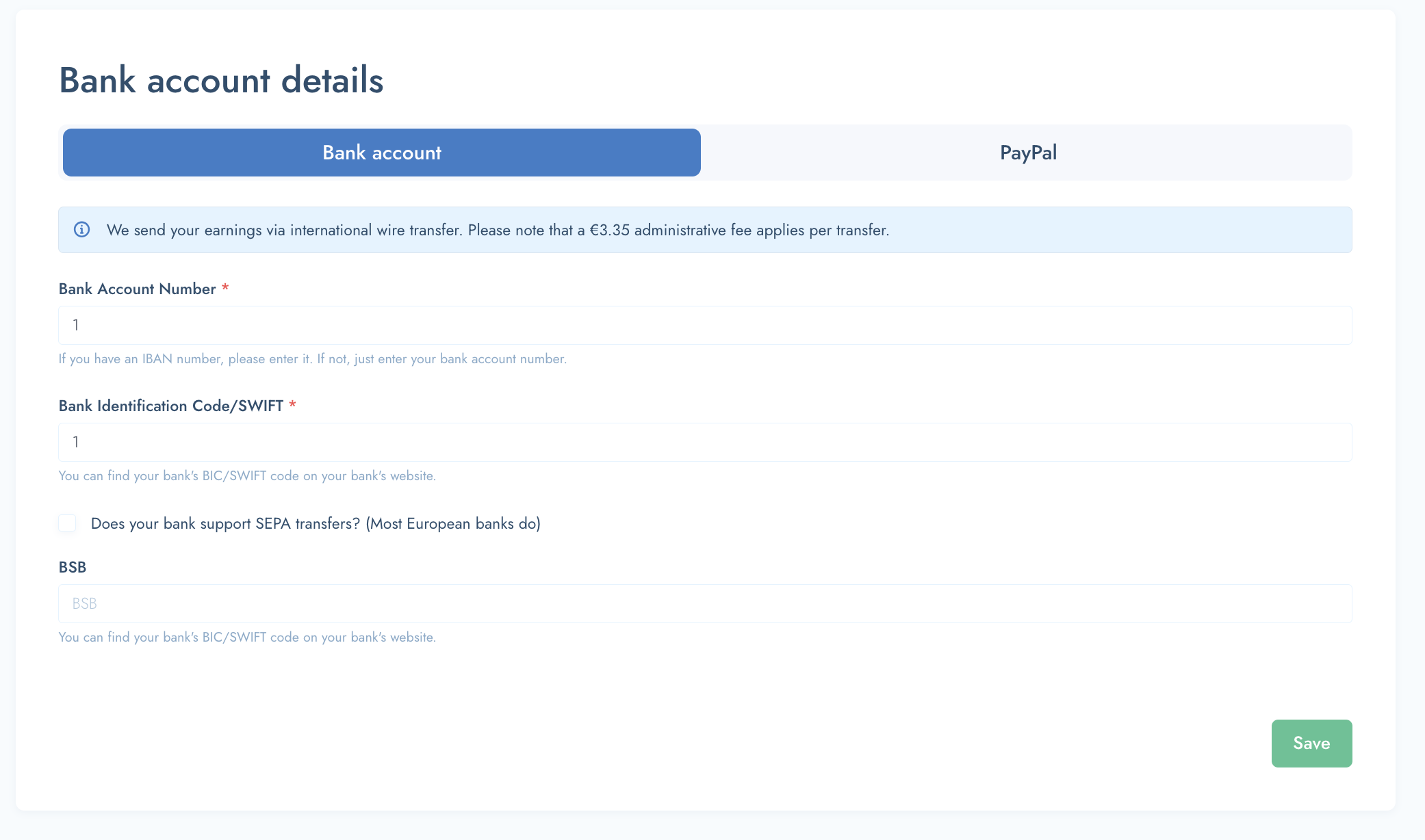

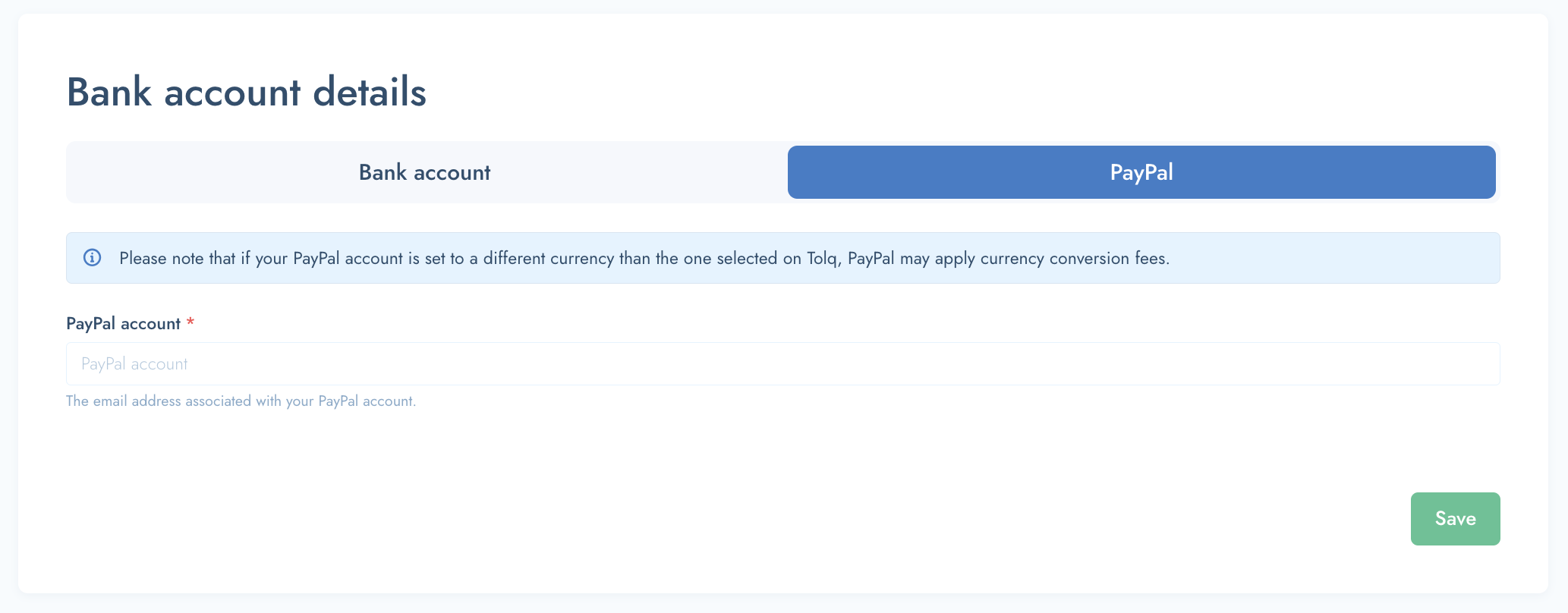

- Now you can select our prefered payment method and enter the associated (correct) details.

- Enter your bank details in the relevant fields.

- You need to enter the following:

- Bank Account / IBAN Number (required)

- Bank Identification Code/SWIFT (required)

- BSB (only for Australian and New Zealand Bank accounts)

- You need to enter the following:

- If you'd like to receive your earnings via PayPal, you must enter the email address associated with your PayPal account.

- Remember to SAVE after you've entered or changed your details and you are good to go!

7. Do I need to create my own invoices?

- No, we automatically generate invoices for you. However, if you require a different invoice format for your records, you can create your own.

- Once you've created your invoice, you can send it to our finance department at finance@tolq.com.

Here's the information you'll need for your invoice:

- Company Name: Tolq.com BV

- VAT Number: NL821514234B01

- Chamber of Commerce Number (KvK): 27361194

- Address: Prinses Margrietplantsoen 33, 2595 AM, Den Haag

Please note that these invoices are for administrative purposes only and are unrelated to payouts. Your earnings will only be transferred to you upon request through a withdrawal in your account, which you can do at any time if you have available earnings.

The invoices we generate are created on the 1st of each month and reflect the earnings released within the previous month.

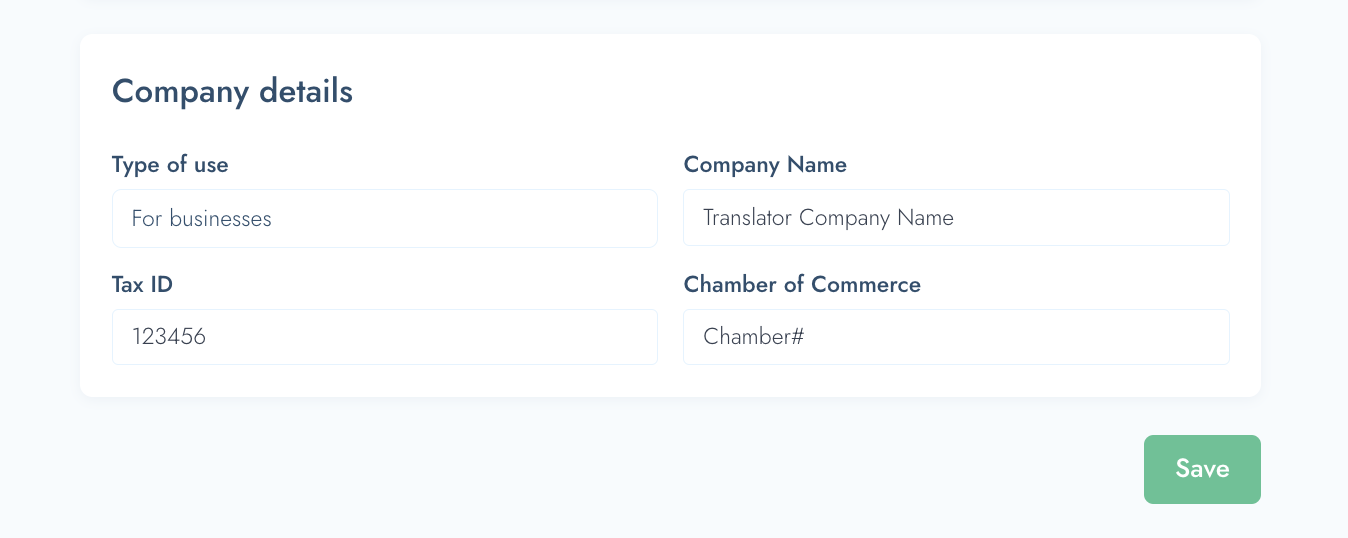

8. I need to charge VAT, how can I do this?

- If you need to charge VAT, simply update your account details by entering your company information, including your Tax ID.

- Once you've entered this information, it will be automatically included on your future invoices.

- Please note that the earnings displayed for tasks on the dashboard are exclusive of VAT.

If you no longer need to charge VAT, you can easily remove your company details, and VAT will no longer be added to your invoices.

- To change or remove your company details, navigate to the "Account Details" page.

- At the bottom of the page you will find the "Company Details" section. Update or change your details here.

9. How does invoicing work?

Invoices are generated on the 1st of each month and are accessible within your profile in the "Invoices" section here.

To ensure you receive your invoice correctly, please ensure you have:

- Provided all relevant details for withdrawals (Bank transfer details or PayPal information)

- Selected your profile preferences for "personal" or "business" use.

What is included in the invoice?

Each invoice includes:

- The total amount (earnings) from all completed translations accepted by clients during the previous month.

- Any withdrawal fees for previous withdrawals.

Didn't receive an invoice?

- You will only receive an invoice if you have completed translations in the previous month.

How do I view all previously completed and accepted tasks?

- You can easily access a comprehensive list of all completed tasks in the 'History' section.

Invoices and withdrawals - Do I receive an invoice for a withdrawal?

- Invoices are not issued for withdrawals you make, and you will not receive an invoice following a withdrawal.

- However, the associated withdrawal fee will be reflected on your next invoice.